how to pay indiana state taxes quarterly

If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

2022 State Business Tax Climate Index Tax Foundation

Your tax projection exceeds 1000 after removing withholding and tax credits during.

. Your browser appears to have cookies disabled. The rules that determine who can make quarterly estimated tax payments for the calendar year 2022 are. In the top right corner click on New to INTIME.

You may also pay using the electronic eCheck payment methodThis service uses a paperless check and may be used to pay the taxdue with your Indiana individual income tax. Tax Lien Balance Inquiry. Cookies are required to use this site.

Individual Payment Type options include. Line I This is your estimated tax installment payment. Make an Individual or Small Business Income Payment.

We last updated the Estimated. Estimated payments may also be made online through Indianas INTIME website. Department of Administration - Procurement Division.

In order to pay individual state of Indiana income tax please follow the following steps. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e. The Indiana income tax rate is set to 323 percent.

Estimated Quarterly Income Tax Returns Form IT-6. To make a payment via INTIME. Check Your Payment Status.

Any employees will also need to pay state income tax. Request Extension of Time to File. Set up a Payment Plan.

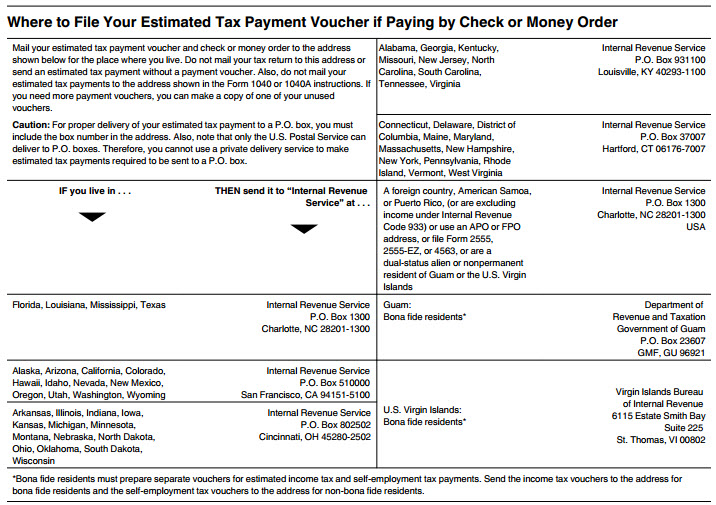

Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. Make an initial corporate estimate income tax payment. Learn about state requirements for estimated quarterly tax payments.

Lines J K and L If you are paying only the. Once logged-in go to the Summary tab and. However some counties within Indiana have an additional tax rate making the.

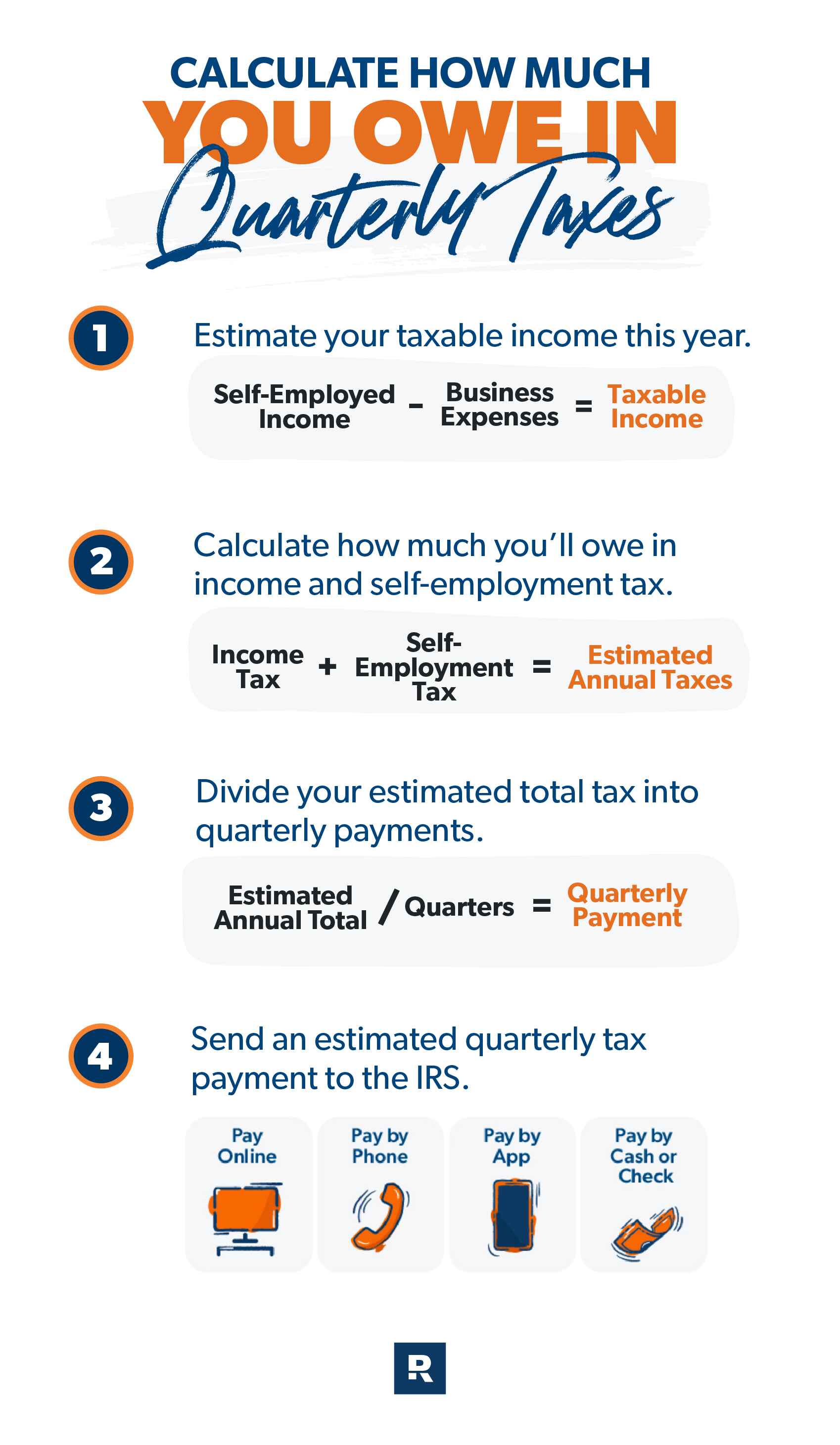

To pay quarterly youll have to. An important step to doing quarterly taxes is finding your net income This forces you to review your businesss financial health beyond just your bank balance. Click on Make Payment or Establish Payment Plan in the.

Make an income tax payment to an already established estimated account for. Access INTIME at intimedoringov. SBAgovs Business Licenses and Permits Search Tool allows you to.

Indiana Small Business Development Center.

Owe State Taxes Here Are Your Payment Options Wbiw

What Are Quarterly Taxes Ramsey

Quarterly Tax Calculator Calculate Estimated Taxes

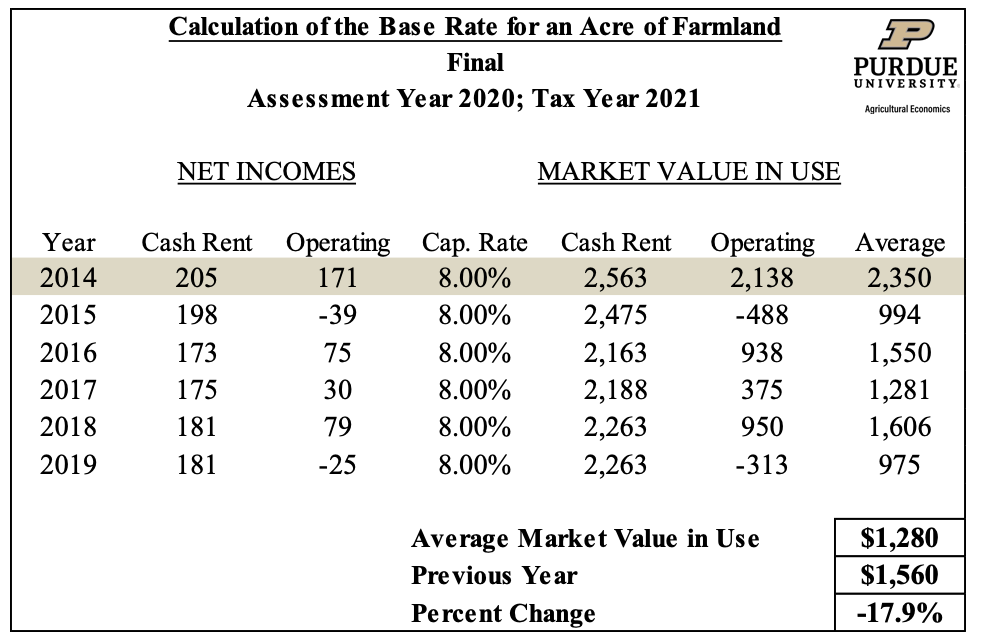

Farmland Assessments Tax Bills Purdue Agricultural Economics

A Complete Guide To Indiana Payroll Taxes

File 1946 Tax Calendar For Indiana Dpla A0cf792992ced8e5fc9e325dfc9b4e15 Page 1 Jpg Wikimedia Commons

Indiana Tax Rates Rankings Indiana State Taxes Tax Foundation

Estimated Quarterly Tax Payments Calculator Bench Accounting

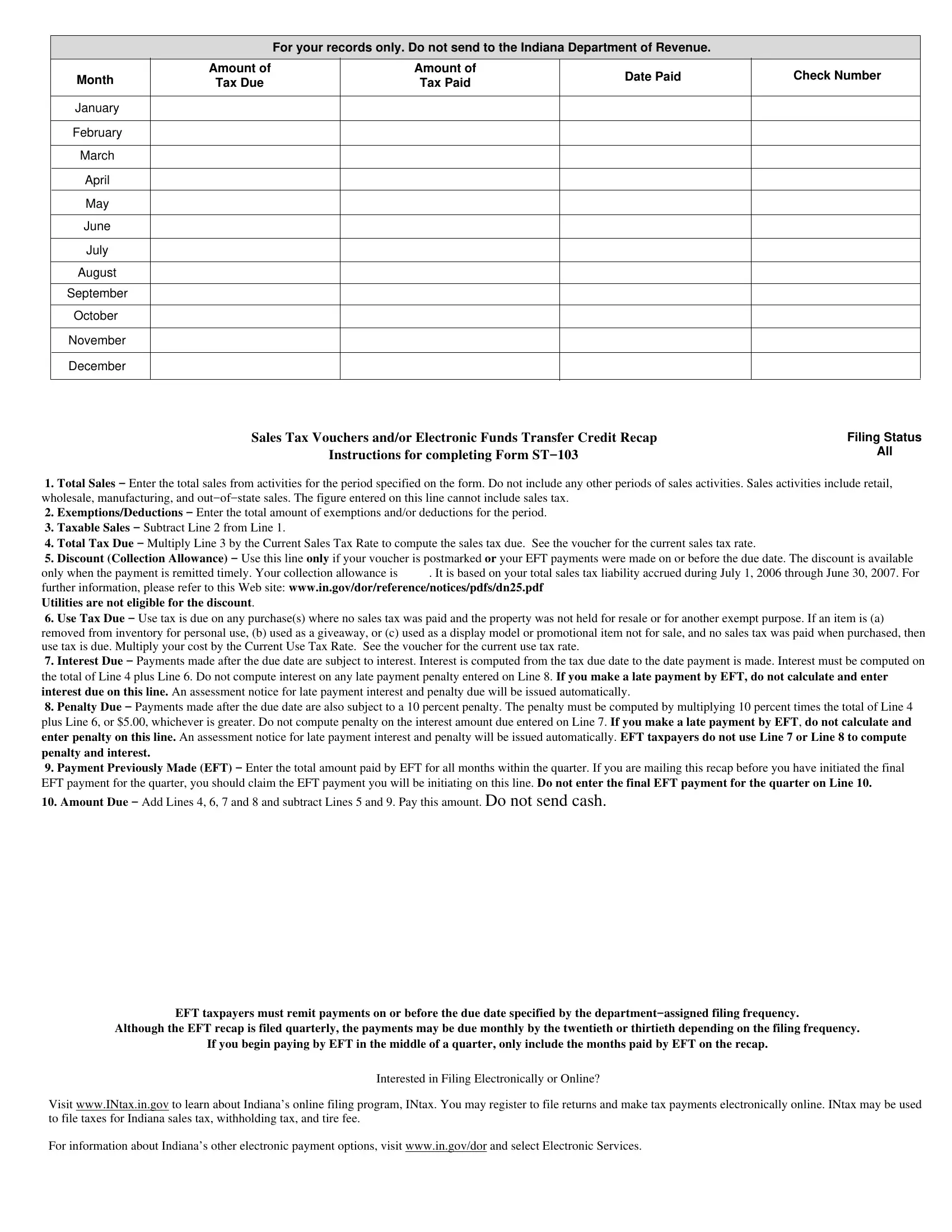

Indiana Form St 103 Fill Out Printable Pdf Forms Online

How To Calculate And Pay Quarterly Estimated Taxes Young Adult Money

How To Calculate And Save Your Quarterly Taxes

Calculating Paying Quarterly Estimated Taxes For A Small Business In Wi Giersch Group Milwaukee Wi 53202

Dor Completing An Indiana Tax Return

Quarterly Tax Calculator Calculate Estimated Taxes

Indiana Paycheck Calculator Smartasset

Quarterly Estimated Tax Payments Who Needs To Pay When And Why

Quarterly Tax Calculator Calculate Estimated Taxes

States Tax Revenue Recovery Improves At Start Of 2021 The Pew Charitable Trusts